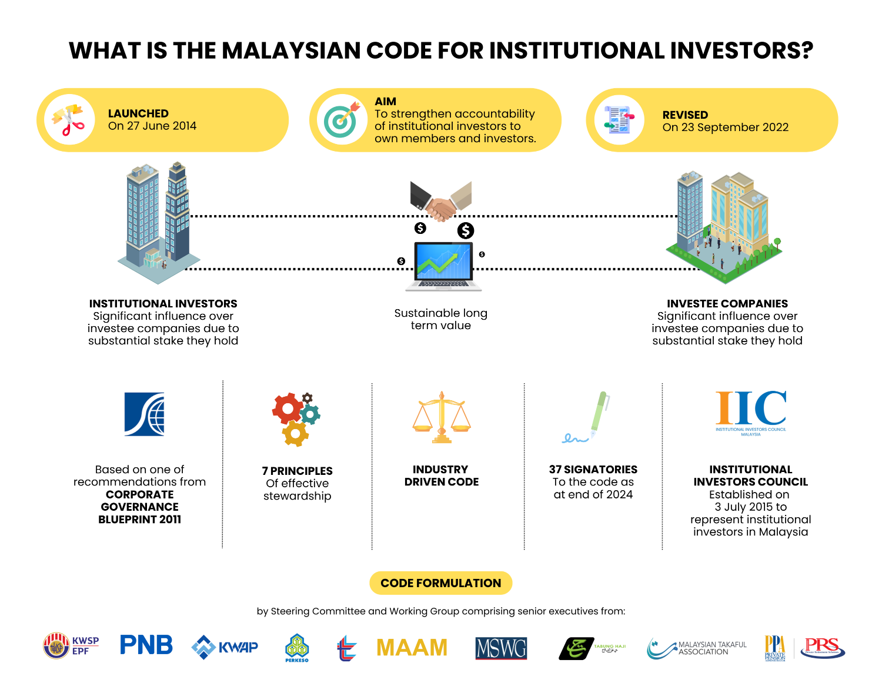

The Malaysian Code for Institutional Investors 2022 (MCII 2022) which supersedes the first edition of the MCII issued on 27 June 2014 was launched on 23 September 2022.

The MCII 2022 adopts the “apply and explain” approach and covers the areas relating to good corporate governance practices and sustainability which institutional investors are expected to focus on in discharging their stewardship responsibility. This revised Code also strengthens the reporting expectations on signatories in order to enhance transparency and facilitate deeper understanding of their stewardship actions and outcomes.

There are two sections in the MCII 2022, first section which is the main part of the Code comprises seven principles including one new principle; and a second section, the “Stewardship Spotlight” which highlights key corporate governance and sustainability matters which should be on the agenda when institutional investors engage their investee companies and where relevant for institutional investors to consider exercising their voting rights.

Under the “apply and explain” approach, institutional investors who are signatories to the MCII 2022 are expected to highlight departures from the Code along with the measures that will or have been taken, and the time frame required to be aligned with the recommendations of the Code.

As at September 2024, there are 37 signatories to the MCII 2022.